Cost Management Report

July-September 2024 issue.

「Construction Costs Continue Steady Rise 1H 2024 Saw High Growth Continue, Similar to Last Year」

Scroll Down

This report has been prepared by the Cost Management Group of the Architectural Design Dept. of Nikken Sekkei Ltd for information purposes. While the information in this report is current as of the date of publication, its completeness is not guaranteed. The contents are subject to change without notice. Unauthorized reproduction of this report is prohibited.

Construction Costs Continue Steady Rise

1H 2024 Saw High Growth Continue, Similar to Last Year

Materials Prices Revised Up On Upward Price Swings, Supply-Demand Gap

Materials Prices Rise Moderately

-

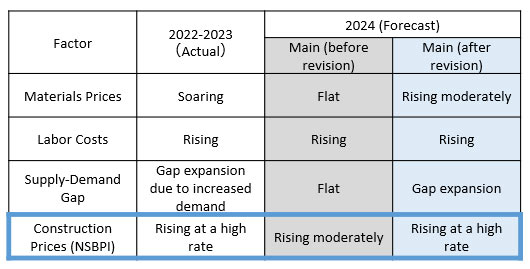

Fig. 1: Revised Forecast of Construction Prices (NSBPI) for 2024

Fig. 1: Revised Forecast of Construction Prices (NSBPI) for 2024

Compiled from Nikken Sekkei data. -

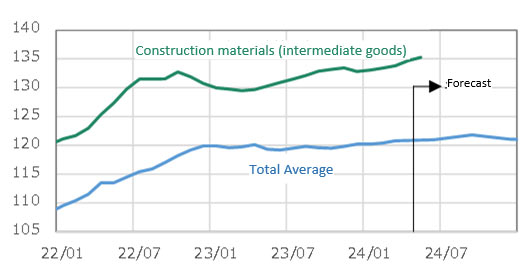

Fig. 2: Change in Corporate Goods Price Index

Fig. 2: Change in Corporate Goods Price Index

Compiled from the Bank of Japan's "Corporate Goods Price Index" and the "Short-term Economic Outlook" from the Japan Centre for Economic Research (JCER). ※ The index for construction materials (intermediate goods) is based on the 2015 index, which accounts for stage of demand & usage, as well as product classification and weight. Forecasts: JCER.

Construction Companies are Curbing Orders and Reducing Work on Hand

Securing Construction Workers is Becoming More Difficult

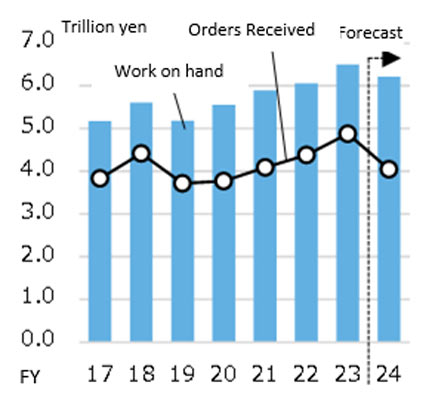

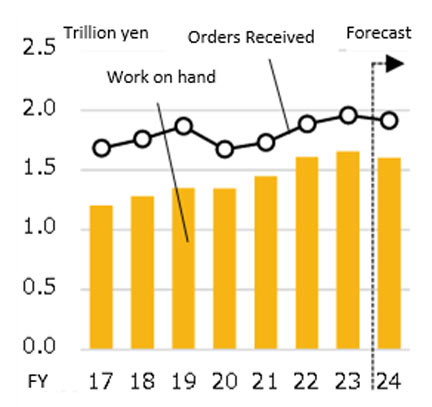

Figs. 3-5: Trends in Work on Hand and Orders Received by Construction Companies

-

Fig. 3: Total of 4 Construction Firms

Fig. 3: Total of 4 Construction Firms

Prepared from each company's financial data. -

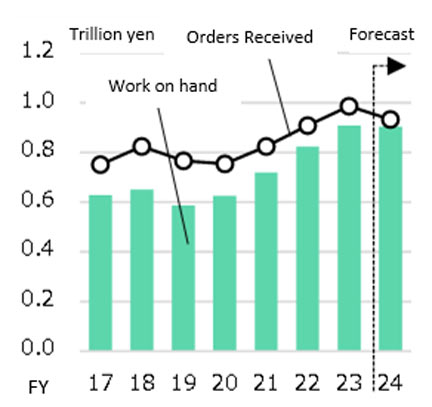

Fig. 4: Total of 5 Machinery Firms

Fig. 4: Total of 5 Machinery Firms

Prepared from each company's financial data. -

Fig. 5: Total of 5 Electrical Equip. Firms

Fig. 5: Total of 5 Electrical Equip. Firms

Prepared from each company's financial data. -

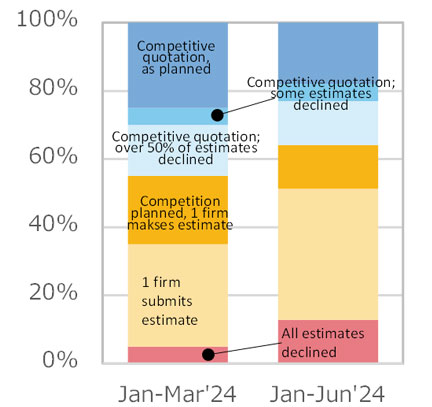

Fig. 6: Bid Estimate Participant Status

Fig. 6: Bid Estimate Participant Status

Compiled from Nikken Sekkei data.

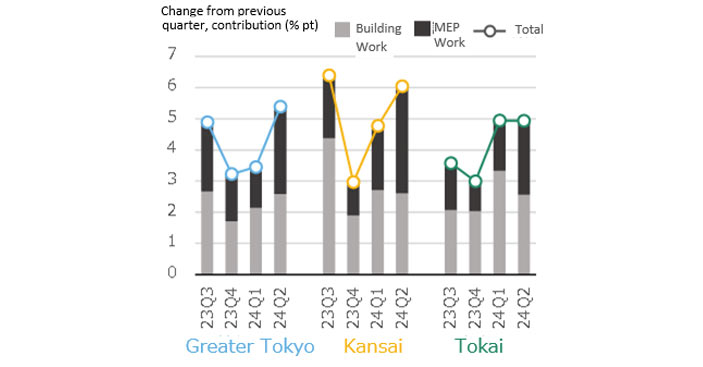

Upward Price Hike Trend Expected to Strengthen Anew in All Regions, with Significant Impact on MEP

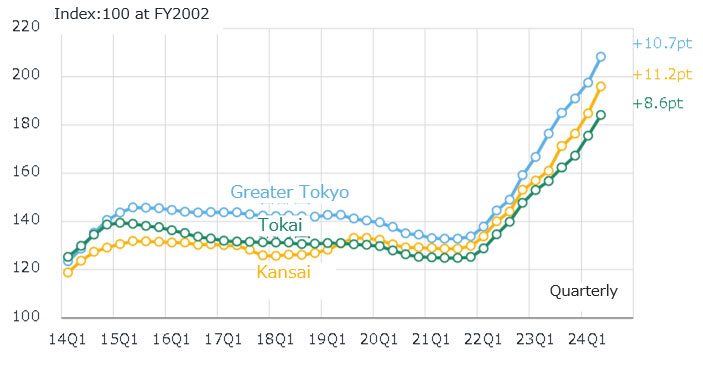

Nikken Sekkei Building Price Index (NSBPI)*4

Similarly, costs are rising for building construction, temporary construction, frame construction, finishing work in general, and for overhead. The widening supply-demand gap is further increasing the trend to reflect higher construction costs in submitted estimates.

-

Fig. 7: Changes in NSBPI

Fig. 7: Changes in NSBPI

-

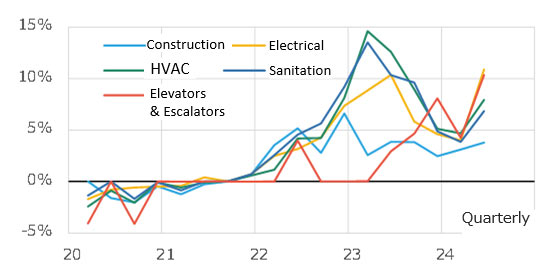

Fig. 8: % Change in NSBPI, Construction Work vs. MEP Work Contribution

Fig. 8: % Change in NSBPI, Construction Work vs. MEP Work Contribution

Elevators and Escalators: Tight Supply and Demand

Conditions have Become More Pronounced

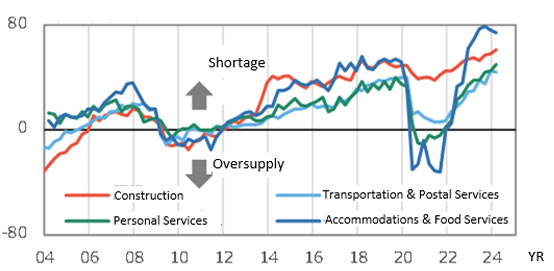

A Growing Sense of Labor Shortage

-

Fig. 9: Change in NSBPI by Construction Work Type vs. Previous Year

Fig. 9: Change in NSBPI by Construction Work Type vs. Previous Year

Compiled from Nikken Sekkei data. -

Fig.10: Change in DI for Employment (Large Firms), by % point

Fig.10: Change in DI for Employment (Large Firms), by % point

Compiled from the Bank of Japan's "National Survey of Enterprises and Short-Term Economic Outlook."

*1: Four companies: Obayashi Corporation, Kajima Corporation, Shimizu Corporation, and Taisei Corporation.

*2: Five companies: Asahi Kogyosha Co., Ltd., Sanki Engineering Co. Ltd., Taikisha, Dai-Dan Co., Ltd., and Takasago Thermal Engineering Co., Ltd.

*3: Five companies: Kandenko, Co., Ltd., Kyudenko Corporation, Kinden Corporation, Toenec Corporation, and Yurtech Corporation.

*4: Nikken Sekkei Standard Building Price Index (NSBPI): An index showing price movements in construction prices, calculated independently by Nikken Sekkei Ltd. Using standard rental office space as a quantitative model, the index is calculated and converted into an index of construction prices that reflect prevailing prices, as identified through independent surveys from time to time. The first quarter (Q1) is from January to March, Q2 is from April to June, Q3 is from July to September, and Q4 is from October to December.