Cost Management Report

April-June 2024 issue.

「Construction Prices Slacken Slightly, but High Rate of Increase Remains Intact; Securing Construction Workers is Also an Issue」

Scroll Down

This report has been prepared by the Cost Management Group of the Architectural Design Dept. of Nikken Sekkei Ltd for information purposes. While the information in this report is current as of the date of publication, its completeness is not guaranteed. The contents are subject to change without notice. Unauthorized reproduction of this report is prohibited.

Construction Prices Slacken Slightly, but High Rate of Increase Remains Intact; Securing Construction Workers is Also an Issue

Orders received remain solid

Profits on completed work remain low

-

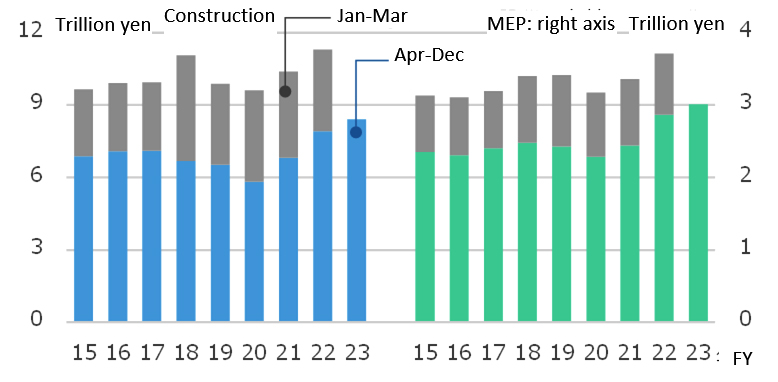

Fig.1: Trends in Orders Received by Builders & MEP Contractors

Fig.1: Trends in Orders Received by Builders & MEP Contractors

Ministry of Land, Infrastructure, Transport and Tourism (MLIT):

A Statistical Survey of Orders Received for Construction Work (50 major companies),Results of a Survey of Orders Received in the Equipment Construction Industry (each of the 20 major construction companies). -

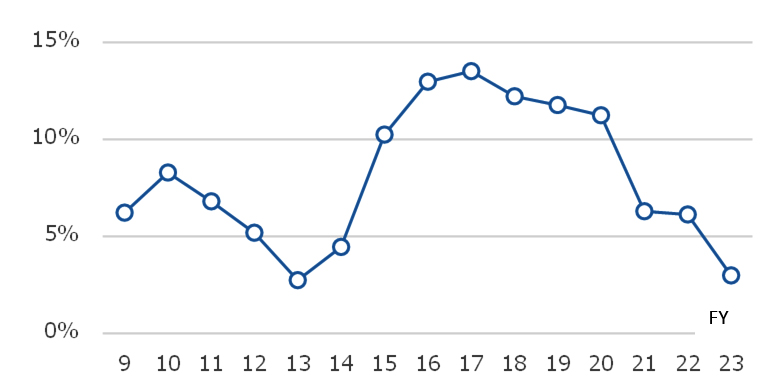

Fig.2: Average Profit Margins on Completed Work at 4 Major Construction Firms

Fig.2: Average Profit Margins on Completed Work at 4 Major Construction Firms

Prepared from each company's financial data.

Construction costs inflation rate moderates slightly, but remains high

Tough contractor selection trend is becoming more pronounced

-

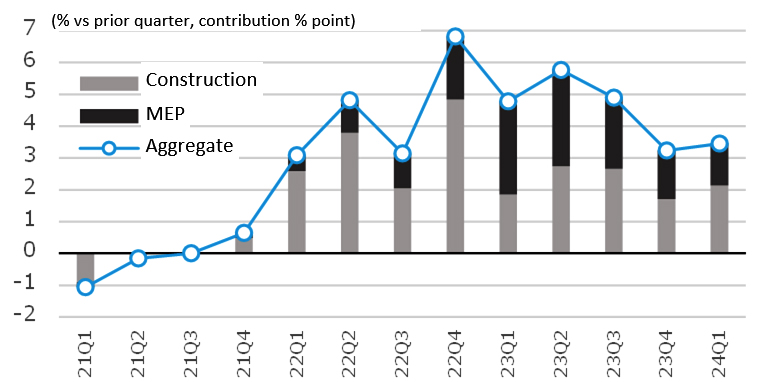

Fig. 3: NSBPI (Metro Area) Rates of Increase

Fig. 3: NSBPI (Metro Area) Rates of Increase

Compiled from Nikken Sekkei data. -

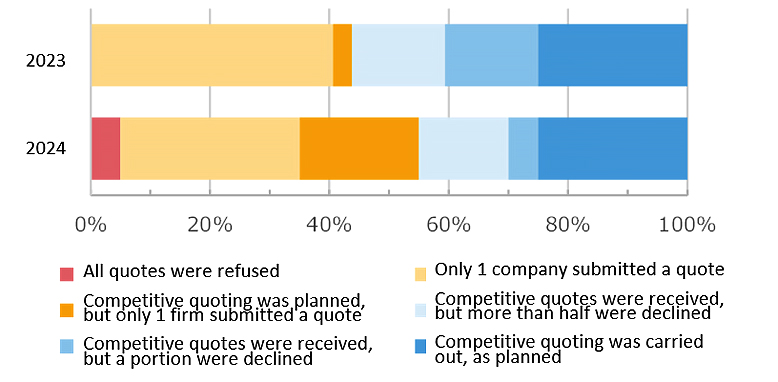

Fig. 4: Construction Quote Participant Status

Fig. 4: Construction Quote Participant Status

Compiled from Nikken Sekkei data.

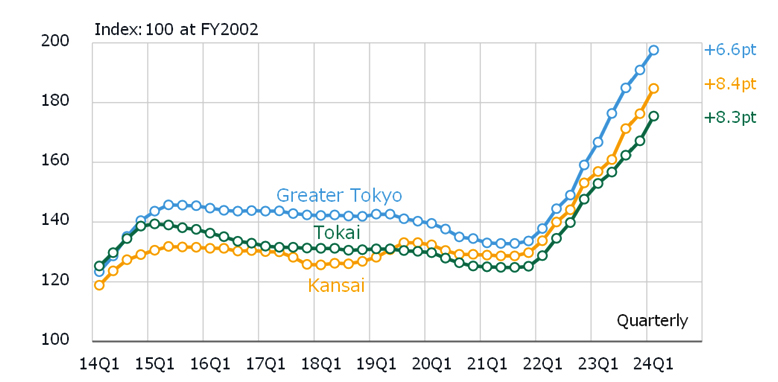

NSBPI: All Regions Continue to Rise; Kansai and Tokai Narrow the Gap with Greater Tokyo

Nikken Sekkei Standard Building Price Index NSBPI*2

-

Fig. 5: Changes in NSBPI

Fig. 5: Changes in NSBPI

-

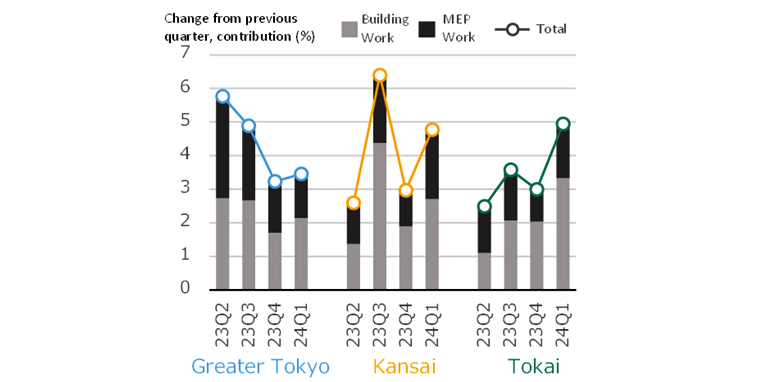

Fig. 6: % Change in NSBPI, Construction Work vs. MEP Work Contribution

Fig. 6: % Change in NSBPI, Construction Work vs. MEP Work Contribution

The NSBPI Building-to-MEP Ratio Shifts: MEP Rises

The Sense of a Labor Shortage Remains at a High Level

-

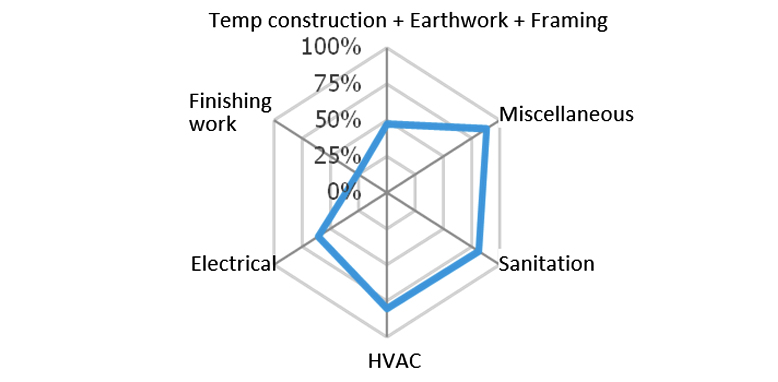

Fig. 7: NSBPI by Construction Task Type, % Increase from July-Sep 2021

Fig. 7: NSBPI by Construction Task Type, % Increase from July-Sep 2021

Compiled from Nikken Sekkei data. -

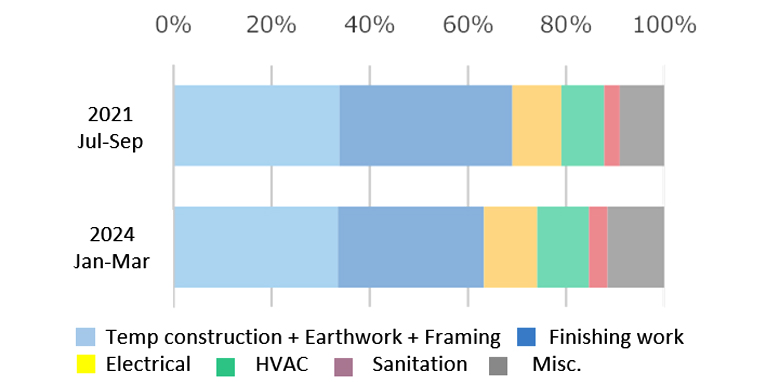

Fig.8: NSBPI Composition Comparison

Fig.8: NSBPI Composition Comparison

Compiled from Nikken Sekkei data. -

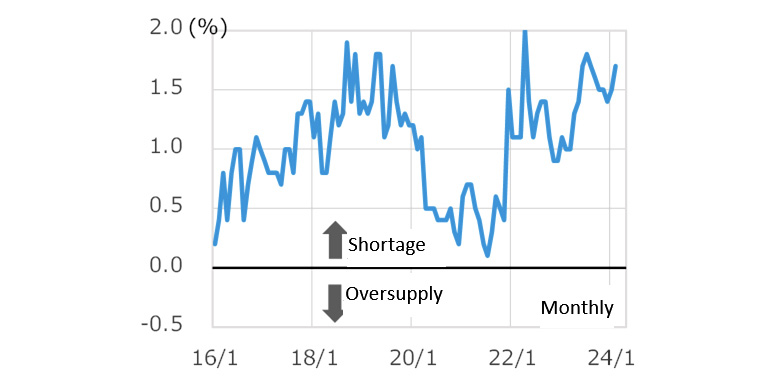

Fig.9: Trends in the Oversupply/Shortage Skilled Construction Worker Ratio

Fig.9: Trends in the Oversupply/Shortage Skilled Construction Worker Ratio

Source: Ministry of Land, Infrastructure, Transport and Tourism (MLIT): Survey of Construction Labor Supply and Demand (eight job categories in all, nationwide, seasonally adjusted).

*1: Overtime work ceiling regulations will be applied to construction and logistics from April 2024.

*2: Nikken Sekkei Standard Building Price Index (NSBPI): An index showing price movements in construction prices, calculated independently by Nikken Sekkei Ltd. Using standard rental office space as a quantitative model, the index is calculated and converted into an index of construction prices that reflect prevailing prices, as identified through independent surveys from time to time. The first quarter (Q1) is from January to March, Q2 is from April to June, Q3 is from July to September, and Q4 is from October to December.