Cost Management Report

「While capital investment may recover in FY2021,

the downward trend in construction prices is expected to continue」

Scroll Down

This report is prepared by Nikken Sekkei Cost Management Group, Quality Management Department for the purpose of providing information only. The contents are as of the date of creation and do not guarantee completeness and are subject to change without notice. All rights reserved.

While capital investment may recover in FY2021,

the downward trend in construction prices is expected to continue

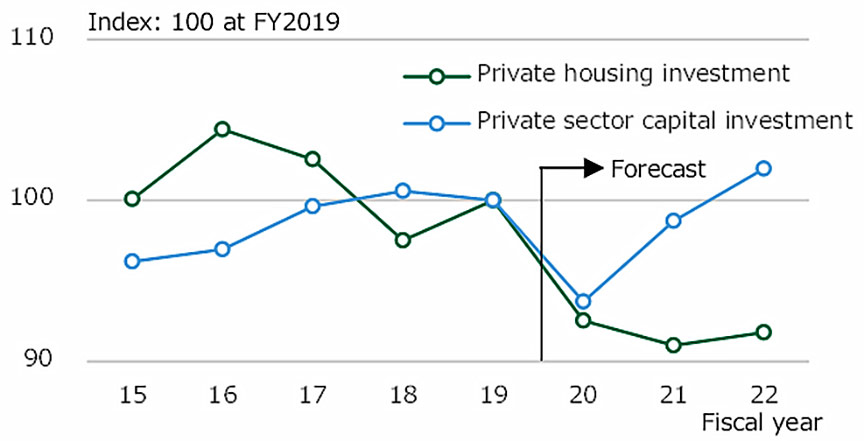

Capital investment in FY2021 expected to fall below that of FY2019

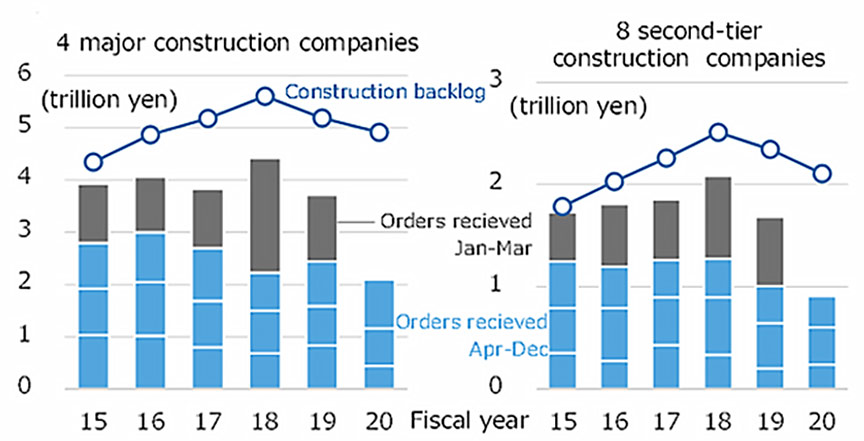

Further decline in construction backlog

* Major construction companies: The four companies of Obayashi Corporation, Kajima Corporation, Shimizu Corporation, and Taisei Corporation. Takenaka Corporation is not included because its quarterly financial results are not disclosed.

* Second-tier construction companies: Of the construction companies with non-consolidated sales exceeding 300 billion yen in the past three years, with the exclusion of Haseko Corporation, these are the eight companies of Hazama Ando Corporation, Kumagai Gumi, Penta-Ocean Construction, Tokyu Construction, Toda Corporation, Nishimatsu Construction, Maeda Corporation, and Sumitomo Mitsui Construction.

-

Fig.1 Historical changes in private sector capital investment and private residential investment, and forecast

Fig.1 Historical changes in private sector capital investment and private residential investment, and forecast

Sources: Cabinet Office "Quarterly Estimates of GDP"; JCER "Short-term Economic Forecast" -

Fig.2 Domestic construction orders and construction backlog of construction companies

Fig.2 Domestic construction orders and construction backlog of construction companies

Source: Created from each company's financial statements

* Construction backlog in FY2020 is the value as of the end of 2020 Dec.

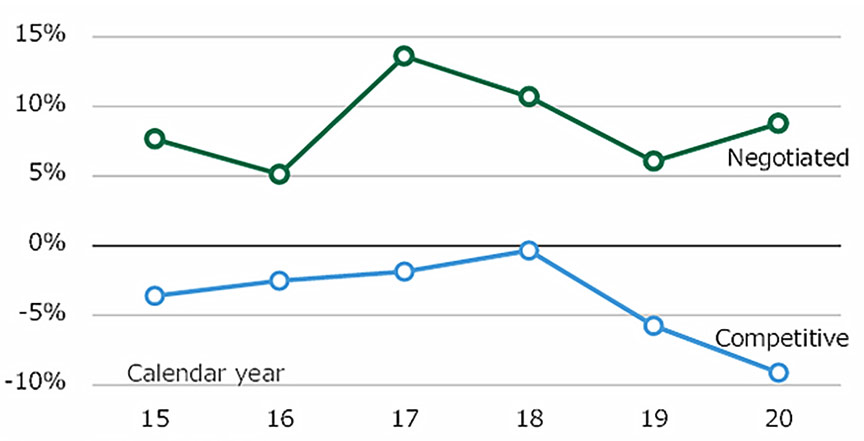

Polarization of competitive bid and negotiated contract prices is increasing

* Average divergence rate: The average of the divergence rates, which indicate how much a project quotation had exceeded (or fallen below) the estimated price, of projects in a given year.

Be cautious of soaring steel prices

-

Fig.3 Average divergence rates of competitive bid contracts and negotiated contracts

Fig.3 Average divergence rates of competitive bid contracts and negotiated contracts

Source: Nikken Sekkei figures

-

Fig.4 Historical changes in ordinary steel price

Fig.4 Historical changes in ordinary steel price

Source: ERA "Construction Material Price Index”

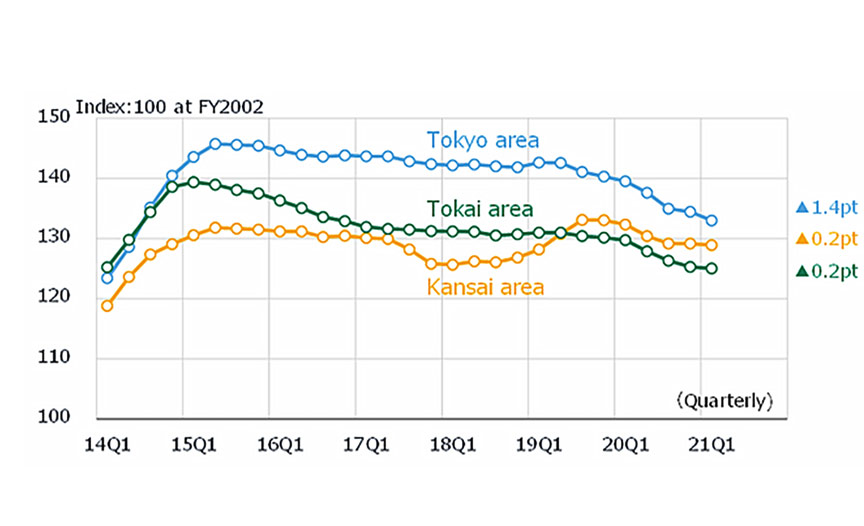

The downtrend continues for the Tokyo, Kansai and Tokai areas

NSBPI

Tokyo area

NSBPI

Kansai area

NSBPI

Tokai area

-

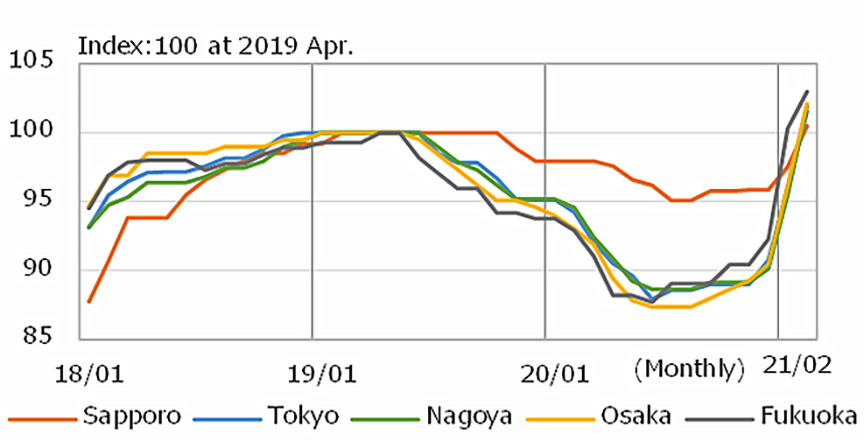

Historical change in NSBPI

Historical change in NSBPI

-

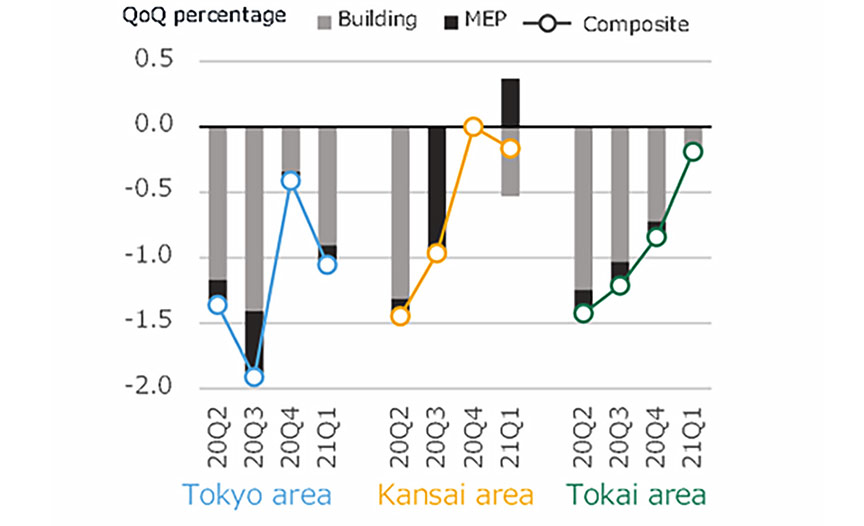

NSBPI increase / decrease rate and contribution of building /services

NSBPI increase / decrease rate and contribution of building /services

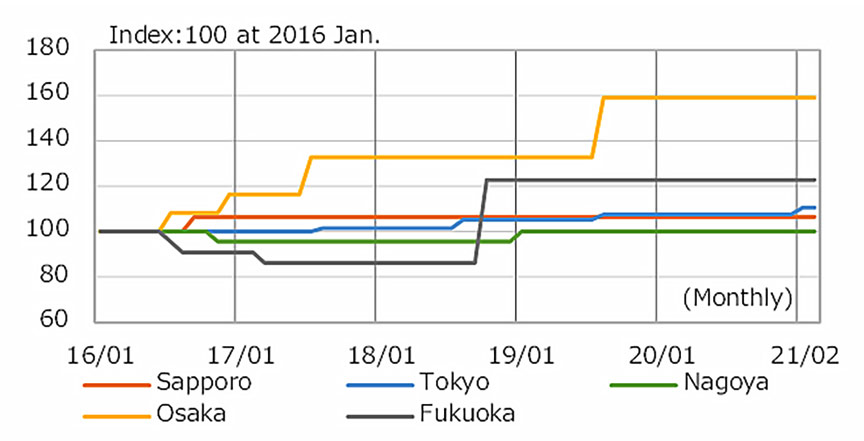

Tokyo’s ready-mixed concrete prices rise

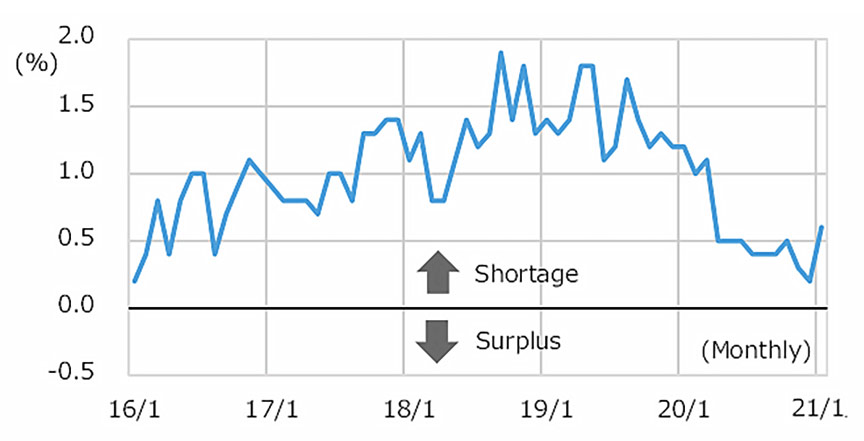

Labor supply and demand is flat

-

Historical changes in ready-mixed concrete price

Historical changes in ready-mixed concrete price

Source: ERA "Construction Materials Price Index" -

Historical changes in supply of skilled labor

Historical changes in supply of skilled labor

Source: MLIT “Construction Labor Supply and Demand Survey (total 8 occupations / nationwide / seasonally adjusted)