Construction Industry Business Sentiment Worsens

Fierce Competition for Orders Continues

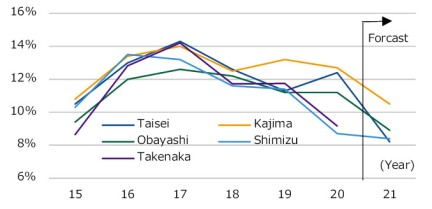

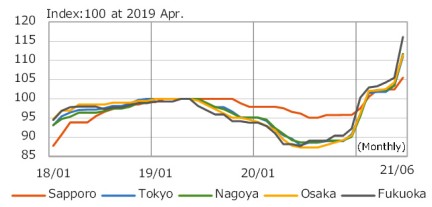

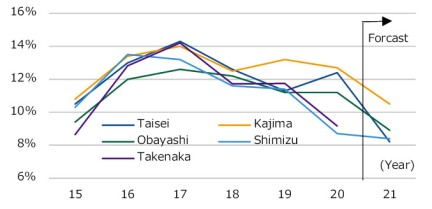

Profit margins on completed construction projects are expected to fall for all companies in FY21

Four out of five major Japanese construction companies (excluding Takenaka as it has yet to comment) are forecasting a decline in profit margins on completed construction contracts in FY2021 (Fig. 1). Since the profit margins on completed construction projects are those on works in progress, the figures reflect the profitability of construction work already ordered, and illustrate that the competition is intensifying.

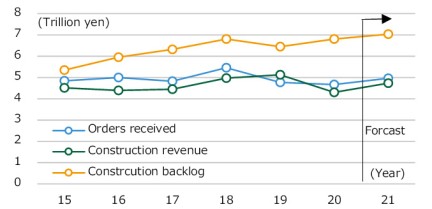

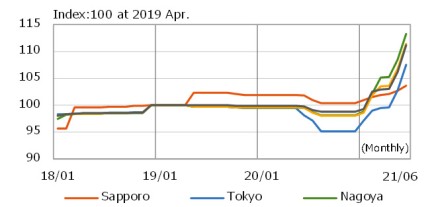

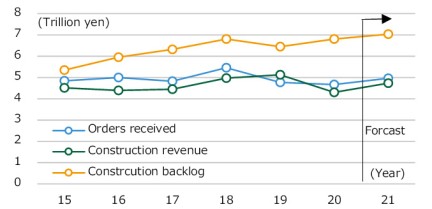

Orders and sales of the five major construction firms fell in FY20

Orders received by all five major construction companies in FY2020 fell 2% from the previous year, and sales were down 16%. The balance of construction work on hand was expected to be at the peak in FY2018, however, it again increased in FY2020 even under tough competition. In FY2021, since the sales will be lower than the orders received, the amount of construction work on hand is expected to increase (Fig. 2).

-

Fig.1 Profit margins on completed construction contracts at the five major construction companies

Fig.1 Profit margins on completed construction contracts at the five major construction companies

Source: Compiled from the financial statements of each company

-

Fig.2 Orders received, sales, and work on hand at the five major construction companies

Fig.2 Orders received, sales, and work on hand at the five major construction companies

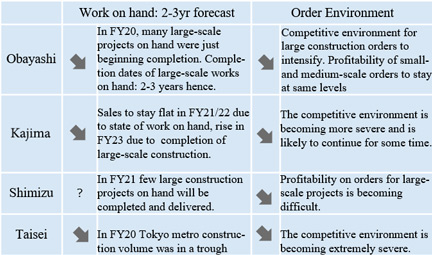

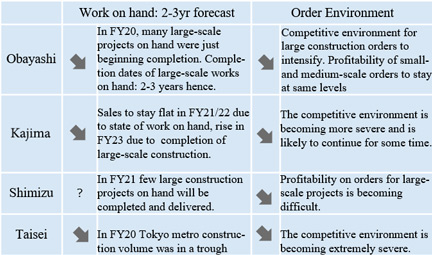

Tough environment for orders continues

Looking at the financial statement, a limited number of large projects on hand will be completed by FY2021, and the rest of many projects will be completed in the next two to three years, of which sales are expected to increase in FY2022 or beyond. If the level of orders received remains unchanged, it’s likely that the amount of construction work on hand will be digested in FY2022 or beyond (Fig. 3). All companies have referred to lower profitability when the orders were received (especially for large projects), and when combined with the balance of the works on hand and due to intention to ensure the orders, the intensified competition for orders is likely to continue.

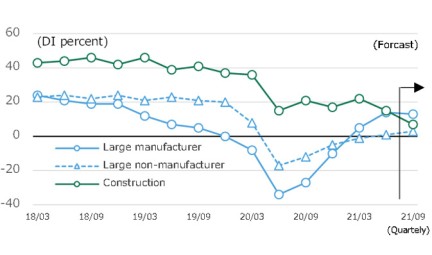

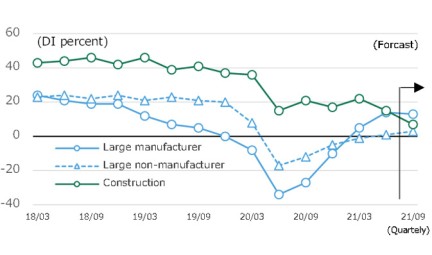

Construction industry business confidence is lower than for manufacturing

As a result, construction industry business confidence is deteriorating, as is the outlook. The Bank of Japan's June 2021 Tankan survey showed that while the manufacturing and non-manufacturing sectors have been recovering since June 2020, the construction sector has been flat and declining (Fig. 4). Although some material prices are rising, the downward trend in construction prices is expected to continue due to growing uncertainty about the future.

-

Fig.3 Comments on Order Environment and Work in Hand

Fig.3 Comments on Order Environment and Work in Hand

Source: Compiled from the financial data of each company

-

Fig.4 Change in DI (Diffusion Index) for business conditions

Fig.4 Change in DI (Diffusion Index) for business conditions

Source: Bank of Japan, Short-term Economic Survey of Enterprises in Japan

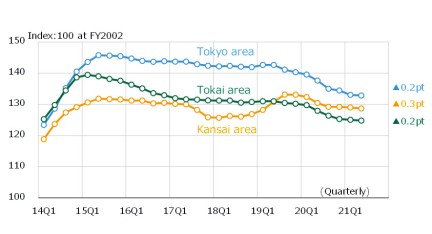

NSBPI Falls Slightly in all 3 Japan Regions

Nikken Sekkei Standard Building Cost Index (NSBPI)

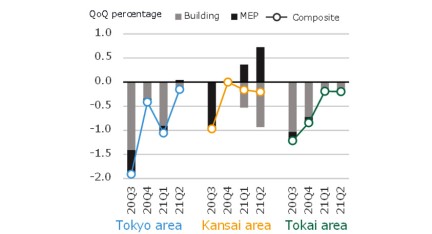

The composite NSBPI fell slightly in the Tokyo metro, Kansai and Tokai regions. As in the previous survey, materials prices such as steel and electrolytic copper were continuing to rise, however, competitions in the tender were still tough, which resulted in pushing down the NSBPI.

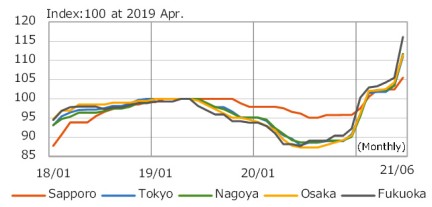

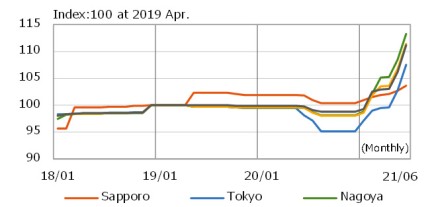

Steel prices continue to rise

Steel prices continued to rise due to high raw material prices and other reasons. Compared to June 2020, when steel began to rise, the prices in Tokyo, Nagoya, Osaka, and Fukuoka were up by 25-30%, and 11% in Sapporo, indicating sharp gains over the past year. Additional price hikes by steelmakers in the future remains a possibility, thus draws further attention.

Wood shock

Beware of rising lumber prices due to wood shock

Similar to steel and copper, the price of vinyl chloride resin has also risen, affecting the prices of wall and floor coverings. Timber prices are also rising due to the wood shock in overseas. Not all of these factors will be passed on to the construction costs, but the higher tender prices and even during construction interim requests for increases in contract prices may occur, thus needs further continuous monitoring.

-

Trends in steel prices (ordinary steel)

Trends in steel prices (ordinary steel)

Source: "Construction Materials Price Index," Economic Research Institute

-

Trends in lumber prices

Trends in lumber prices

Source: "Construction Materials Price Index", Economic Research Council

Fig.1 Profit margins on completed construction contracts at the five major construction companies

Fig.1 Profit margins on completed construction contracts at the five major construction companies Fig.2 Orders received, sales, and work on hand at the five major construction companies

Fig.2 Orders received, sales, and work on hand at the five major construction companies Fig.3 Comments on Order Environment and Work in Hand

Fig.3 Comments on Order Environment and Work in Hand Fig.4 Change in DI (Diffusion Index) for business conditions

Fig.4 Change in DI (Diffusion Index) for business conditions NSBPI Trends

NSBPI Trends

% change in NSBPI and contribution of construction and equipment

% change in NSBPI and contribution of construction and equipment

Trends in steel prices (ordinary steel)

Trends in steel prices (ordinary steel) Trends in lumber prices

Trends in lumber prices