Monitoring the Impact of Rising Materials Prices on Construction Costs

Construction industry business sentiment: no sign of upturn

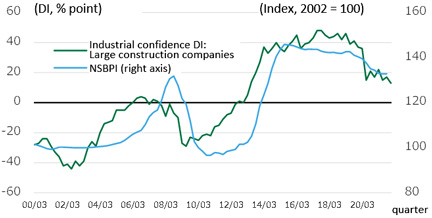

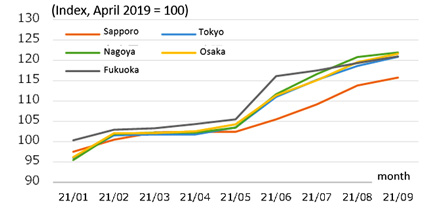

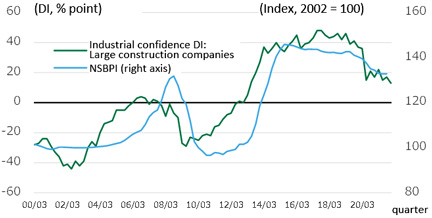

Construction industry business confidence has been flat since it fell sharply in June 2020. A correlation exists between the NSBPI (Nikken Sekkei Building Price Index) and business sentiment in the construction industry as the NSBPI tends to fall when business sentiment falls. Currently, in line with this correlation, with the fall of business sentiment, the NSBPI continues to gradually fall off (Figure 1).

Construction materials prices: sharp rise

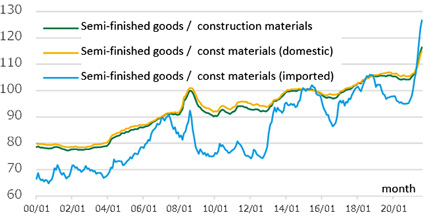

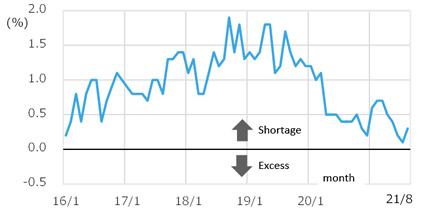

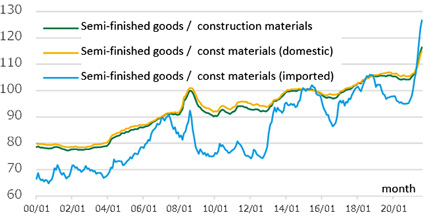

Looking at the prices index investigating the price trend of construction materials, a slow rise that continued since 2000 has risen rapidly after January 2021 (Figure 2). Intermediate goods consisting of concrete, steel, lumber, glass, sashes, plastic products, wiring and piping, etc. for construction indicate that upward pressure on material prices is increasing overall.

-

Figure 1: Trends in the DI (diffusion index) for business conditions

Figure 1: Trends in the DI (diffusion index) for business conditions

Source: Bank of Japan, “Nationwide Survey of Enterprises and the Short-Term Economic Outlook”

-

Figure 2: Changes in the Corporate Goods Price Index

Figure 2: Changes in the Corporate Goods Price Index

Source: Bank of Japan, “Corporate Goods Price Index by Demand Type and Use”

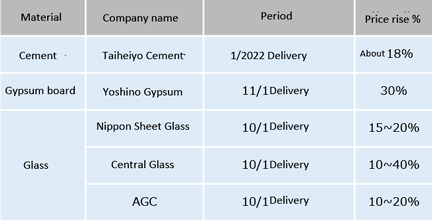

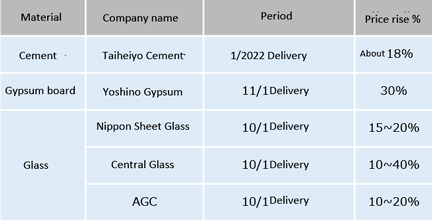

A series of materials price hikes

As materials prices have been increasing and due to the addition of rising logistics costs, manufacturers are announcing price hikes (Figure 3) . Companies other than those listed in Figure 3, Sangetsu (wall and flooring materials), Daiken (flooring materials), Asahi Kasei Construction Materials and Clion (ALC), etc. have also announced price escalations, which pushes remaining manufacturers to follow.

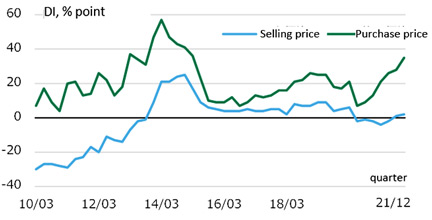

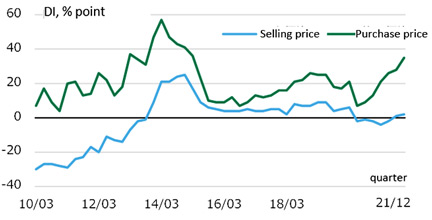

Divergence between sales prices and purchase prices

Rising materials prices will normally affect construction industry purchase prices. The Bank of Japan's Tankan survey (short-term economic outlook) of purchasing prices (large construction companies) shows that the DI (diffusion index) has been rising since June 2020. In contrast, the DI for sales prices has remained flat, with the gap between purchase prices widening (Figure 4). If the purchase prices continue to rise, even in the context of declining business sentiment, builders may not be able to absorb them despite their best efforts and this will ultimately be reflected in price quotes even for competitive projects, which will result in higher construction prices.

-

Figure 3: Trends in materials price increases

Figure 3: Trends in materials price increases

Source: Compiled from various press materials

-

Figure 4: DI for Sales Price & Purchase Price Judgments: Big Construction Firms

Figure 4: DI for Sales Price & Purchase Price Judgments: Big Construction Firms

Source: Bank of Japan's National Survey of Enterprises and the Economy

DI = % of firms that judged prices to rise MINUS % of firms that judged prices to fall

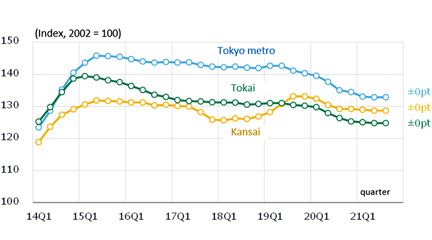

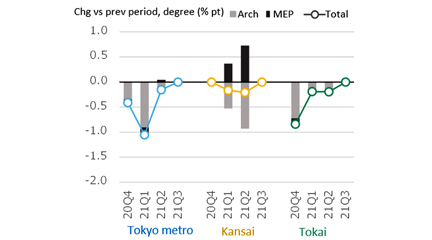

NSBPI Unchanged from Prior Quarter in All Three Regions

Nikken Sekkei Standard Building Price Index NSBPI

The overall price indexes for the Tokyo metropolitan area, the Kansai region, and the Tokai region remain unchanged from the previous quarter. Although the prices of materials such as steel and electrolytic copper continue to rise, the NSBPI has yet been pushed up due to strong pressure on order competition.

Steel prices have risen 9% from the previous newsletter (June)

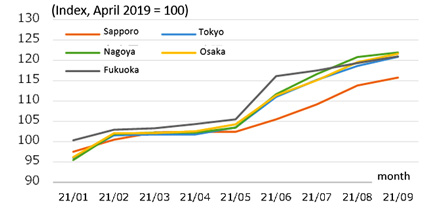

Steel prices have not stopped rising. Compared to the previous issue of this newsletter (June), prices in Tokyo, Nagoya, and Osaka have risen by 9%, by 10% in Sapporo and by 4% in Fukuoka, showing that the higher prices continue (Figure 7). The price of steel scrap as a raw material continues to rise due to demolition work stagnation and continued monitoring on price escalation is needed.

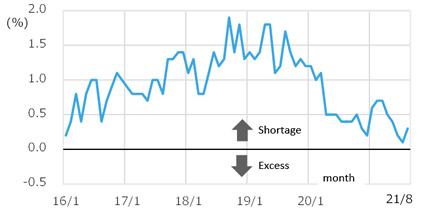

The labor shortage remains at a low level, having no effect on labor costs

Since April 2020, the labor shortage has eased and remains at a low level (Figure 8). Figure 8 shows the excess/shortage of labor rate for eight jobs. Amongst these, the plasterer shortage rate is as high as +1.2%, while the formworker and rebar worker shortage rates are low at -0.1% and -0.9% (excess) respectively. The overall shortage remains low, however, the number of construction workers is decreasing as the Japanese population ages so that labor costs are unlikely to downturn further.

-

Figure 7: Trends in steel prices (ordinary steel)

Figure 7: Trends in steel prices (ordinary steel)

Source: Compiled from "Cost Estimation Data" by the Economic Research Institute

-

Figure 8: Trends in the excess/shortage ratio of skilled construction workers

Figure 8: Trends in the excess/shortage ratio of skilled construction workers

Source: Ministry of Land, Infrastructure, Transport and Tourism, "Construction Labor Supply and Demand Survey” (eight occupations, nationwide, seasonally adjusted)

Figure 1: Trends in the DI (diffusion index) for business conditions

Figure 1: Trends in the DI (diffusion index) for business conditions Figure 2: Changes in the Corporate Goods Price Index

Figure 2: Changes in the Corporate Goods Price Index Figure 3: Trends in materials price increases

Figure 3: Trends in materials price increases Figure 4: DI for Sales Price & Purchase Price Judgments: Big Construction Firms

Figure 4: DI for Sales Price & Purchase Price Judgments: Big Construction Firms Figure 5: Changes in NSBPI

Figure 5: Changes in NSBPI

Figure 6: Percentage change in NSBPI and contribution of building and equipment

Figure 6: Percentage change in NSBPI and contribution of building and equipment

Figure 7: Trends in steel prices (ordinary steel)

Figure 7: Trends in steel prices (ordinary steel) Figure 8: Trends in the excess/shortage ratio of skilled construction workers

Figure 8: Trends in the excess/shortage ratio of skilled construction workers