Cost Management Report

「Competitive conditions persist Rising materials prices to push up construction costs」

Scroll Down

This report has been prepared by the Cost Management Group of the Engineering Division of Nikken Sekkei Ltd for information purposes. The information in this report is current at the time of publication and its completeness cannot be guaranteed. The contents are subject to change without notice. Unauthorized reproduction of this report is prohibited.

Competitive conditions persist Rising materials prices to push up construction costs

Orders received, work on hand steady

*Obayashi Corporation, Kajima Corporation, Shimizu Corporation and Taisei Corporation. Takenaka Corporation is not included because it does not disclose its quarterly results.

Difficult competitive environment continues

-

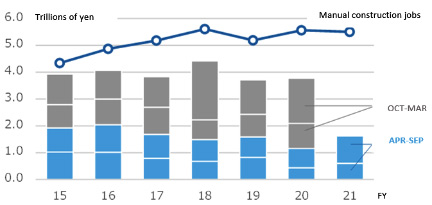

Fig. 1: Trends in orders received and work-on-hand at 4 major construction firms

Fig. 1: Trends in orders received and work-on-hand at 4 major construction firms

Source: Compiled from the financial data of each firm. The count for construction projects on hand in FY21 is as of September. -

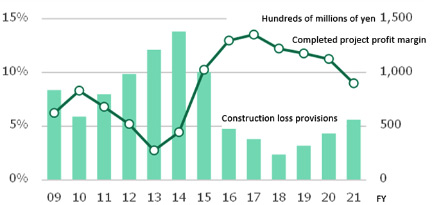

Fig. 2: Trends in profit margins & provisions for losses on construction contracts at 4 major construction firms

Fig. 2: Trends in profit margins & provisions for losses on construction contracts at 4 major construction firms

Source: Compiled from the financial data of each firm. The count for construction projects on hand in FY21 is as of Sept. Figures for profit margin on completed construction & allowance for loss on construction = 4-company avg.

The increase in large construction projects is a competitive factor

Materials prices are increasing

Construction costs are rising

-

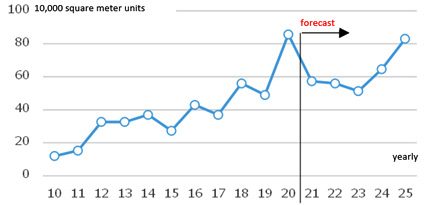

Fig. 3: Supply of office space of 100,000 sq.m. or more per unit in Tokyo's 23 wards / 3-year historical moving average

Fig. 3: Supply of office space of 100,000 sq.m. or more per unit in Tokyo's 23 wards / 3-year historical moving average

Source: Mori Building survey of large-scale office building market trends in Tokyo's 23 wards. -

Fig. 4: Price index of construction materials

Fig. 4: Price index of construction materials

Source: Bank of Japan: Corporate Goods Price Index by Demand Level and Use.

NSBPI Rises Slightly in All Three Districts

Nikken Sekkei Standard Building Cost Index (NSBPI)

-

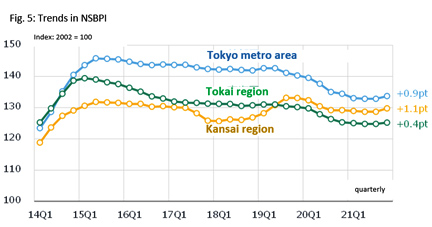

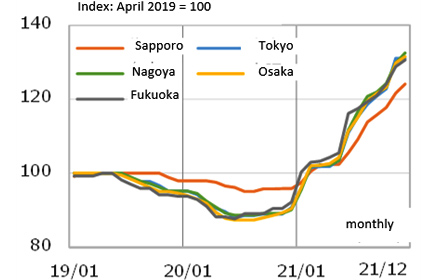

Fig. 5: Trends in NSBPI

Fig. 5: Trends in NSBPI

-

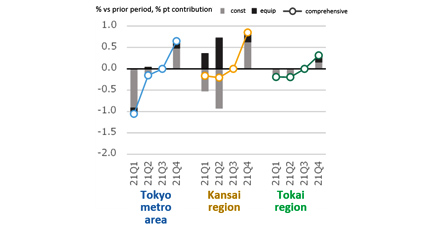

Fig. 6: % change in NSBPI & contribution of construction and equipment

Fig. 6: % change in NSBPI & contribution of construction and equipment

Steel prices continue to rise

Lumber price rise pauses

Labor shortage persists

-

Fig. 7: Changes in steel prices (ordinary steel)

Fig. 7: Changes in steel prices (ordinary steel)

Source: Economic Research Council cost estimation data -

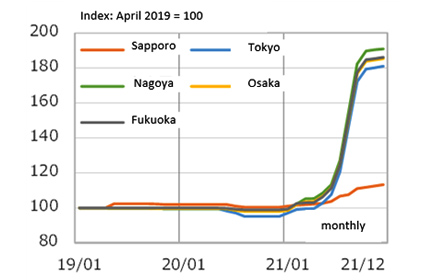

Fig. 8: Trends in timber prices

Fig. 8: Trends in timber prices

Source: Economic Research Council cost estimation data -

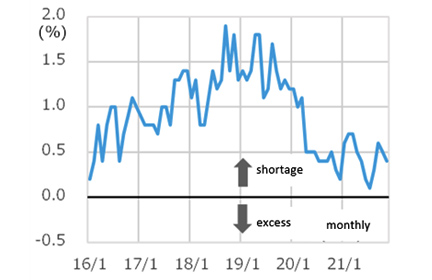

Fig. 9: Trends in the “over/under” ratio of skilled construction workers

Fig. 9: Trends in the “over/under” ratio of skilled construction workers

Source: Ministry of Land, Infrastructure, Transport and Tourism, construction labor supply & demand survey (8 occupations, nationwide, seasonally adjusted)