Cost Management Report

「Price Hikes for Materials Expands Upward Pressure on Construction Costs Beyond Control」

Scroll Down

This report has been prepared by the Cost Management Group of the Engineering Dept. of Nikken Sekkei Ltd for information purposes. The information in this report is current as of the date of publication. Its completeness is not guaranteed, however. The contents are subject to change without notice. Unauthorized reproduction of this report is prohibited.

Price Hikes for Materials Expands Upward Pressure on Construction Costs Beyond Control

Orders received are steady, but competitive environment remains severe

*Leading construction companies: Obayashi Corporation, Kajima Corporation, Shimizu Corporation, and Taisei Corporation. Takenaka Corporation is not included due to non-disclosure of quarterly financial results.

Divergence between construction cost index and materials price index widens

-

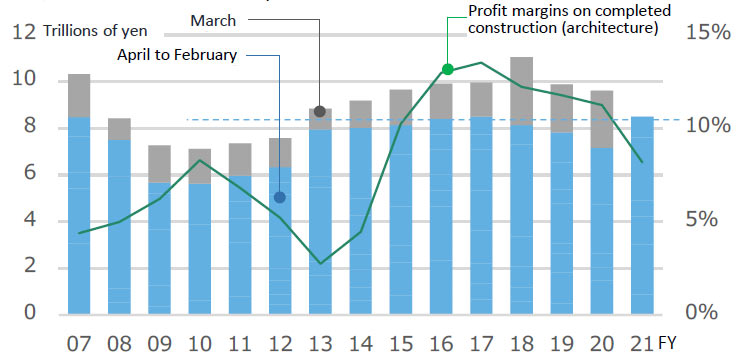

Fig.1: Trends in profit margins on completed contracts for the four major construction companies

Fig.1: Trends in profit margins on completed contracts for the four major construction companies

Source: Compiled from the Ministry of Land, Infrastructure, Transport and Tourism's "Current Survey of Construction Orders (50 Major Companies)" + various financial data. Figures for FY 2021 profit margins on completed const. projects are current through Dec.

-

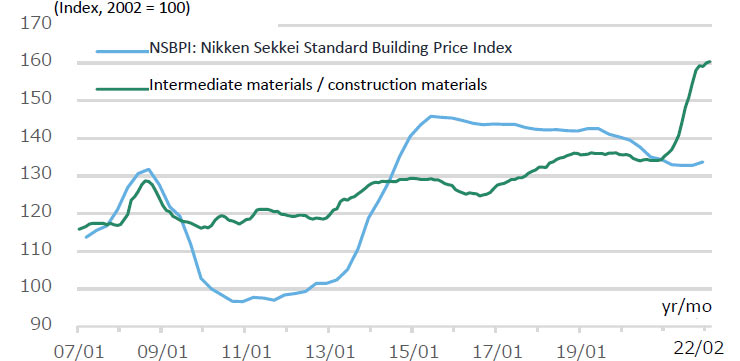

Fig.2: Nikken Sekkei Standard Building Price Index (NSBPI) and the Producer Price Index for Construction Materials

Fig.2: Nikken Sekkei Standard Building Price Index (NSBPI) and the Producer Price Index for Construction Materials

Source: Compiled from the Bank of Japan's "Corporate Goods Price Index by Stage of Demand and Use”.

Fluctuations in materials prices partially impact construction costs

Preparing for future construction price rises is important

-

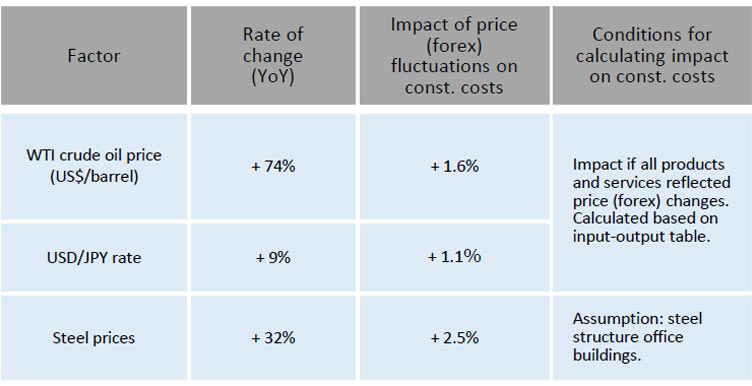

Fig.3: Impact of Fluctuations in Crude Oil Price, Exchange Rates (Forex), and Steel Price on Construction Costs

Fig.3: Impact of Fluctuations in Crude Oil Price, Exchange Rates (Forex), and Steel Price on Construction Costs

Source: The World Bank's "Commodity Prices," the Bank of Japan's "Exchange Rates," the Economic Research Institute's “Construction Materials Price Index," Saitama Prefecture's "Price Fluctuation Analysis Tool," and Nikken Sekkei’s project data.

Figures as of March 2022. -

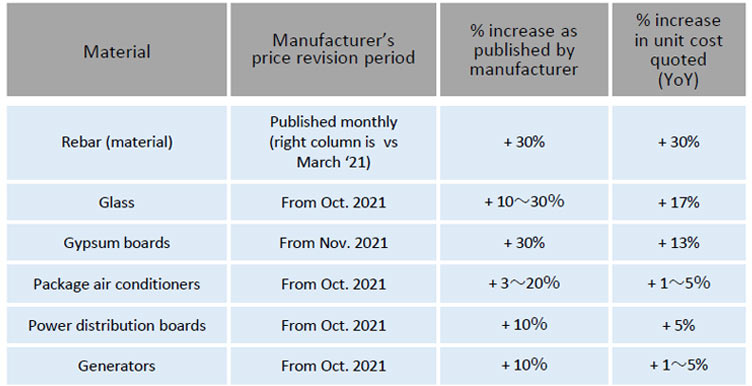

Fig.4: Material Manufacturers' Price Revisions and their Respective Reflection in Contractors' Estimated Prices

Fig.4: Material Manufacturers' Price Revisions and their Respective Reflection in Contractors' Estimated Prices

Source: Based on documents published by each company and Nikken Sekkei's project data. Figures as of March 2022.

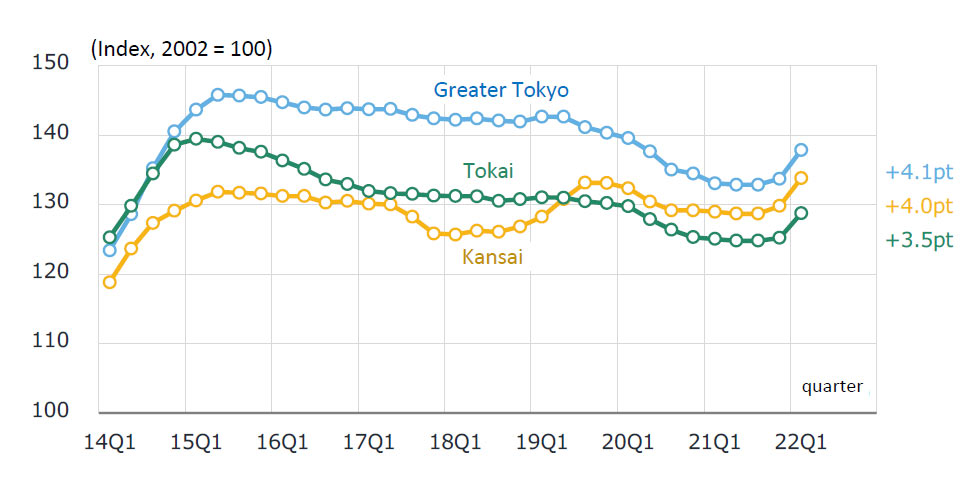

NSBPI Rises in All Three Regions

Nikken Sekkei Standard Building

Price Index (NSBPI)

Until the previous period, the increase in the total amount of quotations had tended to be limited by adjusting the price increases for steel materials and some facility equipment and materials with other types of construction work. In the current period, however, the increase has been larger due to continued price increases for steel, equipment and materials, in addition to price hikes on finishing materials, equipment and labor.

-

Fig.5: Changes in NSBPI

Fig.5: Changes in NSBPI

-

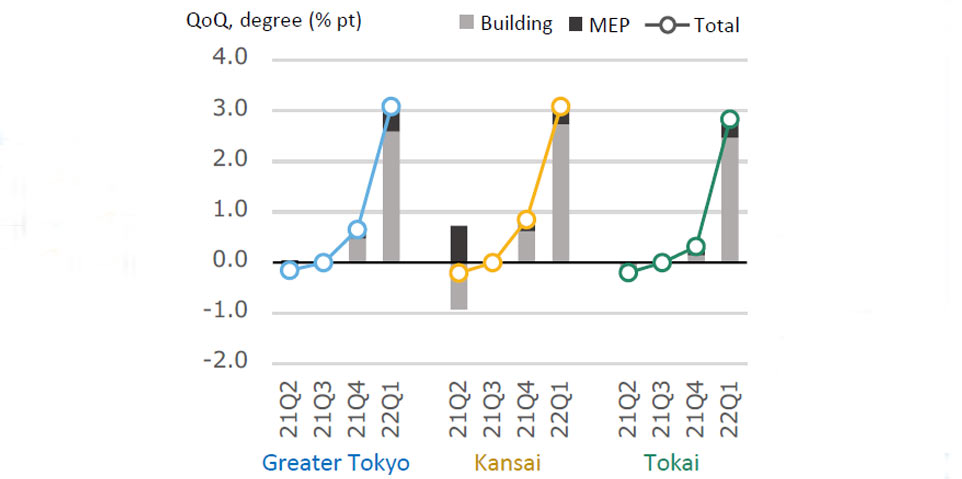

Fig.6: % Change in NSBPI and Contribution of Construction and Equipment

Fig.6: % Change in NSBPI and Contribution of Construction and Equipment

After a lull, steel prices show signs of rising again

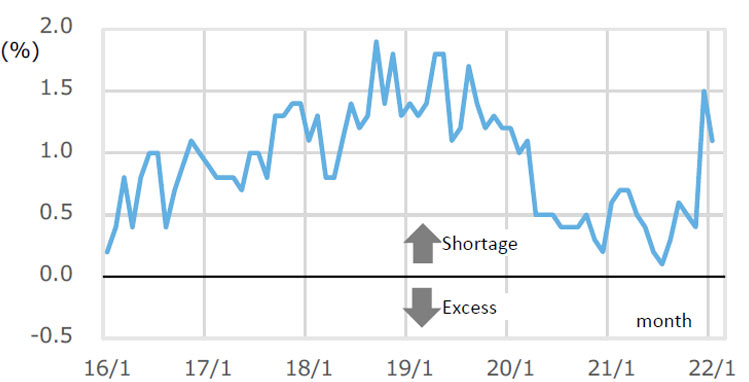

A Growing sense of labor shortage

-

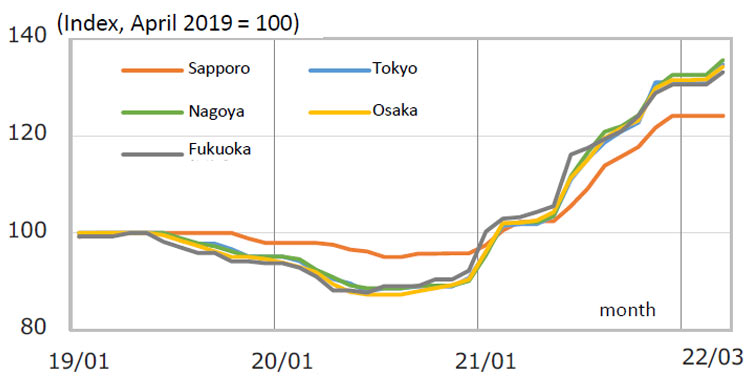

Fig.7: Trends in Steel Materials Prices (Ordinary Steel)

Fig.7: Trends in Steel Materials Prices (Ordinary Steel)

Source: Economic Research Institute’s "Construction Materials Price Index " -

Fig.8: Construction Skilled Worker Excess/Shortage Ratio

Fig.8: Construction Skilled Worker Excess/Shortage Ratio

Source: Ministry of Land, Infrastructure, Transport and Tourism, "Survey of Construction Labor Supply and Demand" (eight job categories, nationwide, seasonally adjusted)