Cost Management Report

「Impact of Rising Material Prices & Delivery Delays is Increasing

Maintaining a Competitive Environment is Critical to Controlling Risk」

Scroll Down

This report was prepared for informational purposes by the Cost Management Group, Engineering Department, Nikken Sekkei Ltd. The contents of this report are current as of the date of preparation, but completeness is not guaranteed. The contents of this report are subject to change without notice. Unauthorized reproduction is prohibited.

Impact of Rising Material Prices & Delivery Delays is Increasing

Maintaining a Competitive Environment is Critical to Controlling Risk

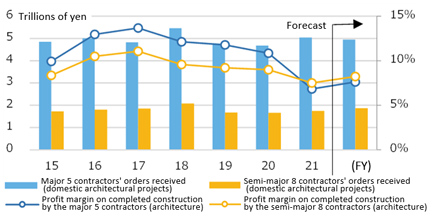

Forecast for orders received is on par with the prior FY

Profit margin recovery is expected, but at a low level

*1: Major construction contractors: Obayashi Corporation, Kajima Corporation, Shimizu Corporation, Taisei Corporation, and Takenaka Corporation.

*2: Semi-major construction contractors: Eight construction contractors (excluding Haseko Corporation) with individual sales of more than 250 billion yen in the past three years, including Hazama Ando Corporation, Kumagai Gumi Co., Ltd., Penta-Ocean Construction Co. Ltd., Tokyu Construction Co., Ltd., Toda Corporation, Nishimatsu Construction Co., Ltd., Maeda Corporation, and Sumitomo Mitsui Construction Co., Ltd.

Awareness of soaring materials prices and delivery delays heightens

-

Fig.1: Construction orders received & profit margins on completed work for major and semi-major construction contractors

Fig.1: Construction orders received & profit margins on completed work for major and semi-major construction contractors

Source: Prepared from various financial data -

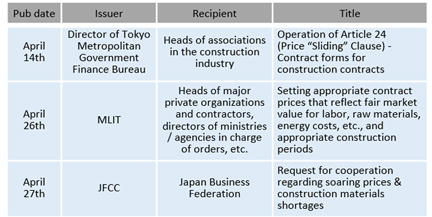

Fig.2: Documents related to setting appropriate contract prices and construction periods

Fig.2: Documents related to setting appropriate contract prices and construction periods

Source: Prepared from various press materials

MLIT: Ministry of Land, Infrastructure, Transport and Tourism

JFCC: Japan Federation of Construction Contractors

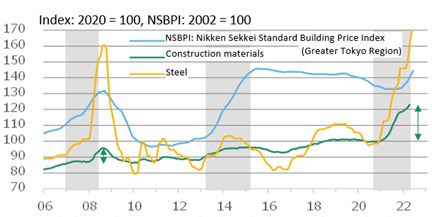

Difference from 2007-2008:soaring prices for many materials, not only steel

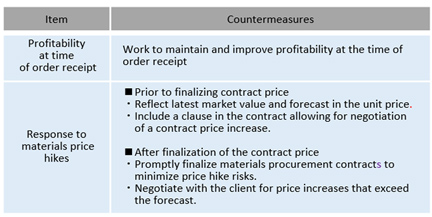

Price fluctuation risk exists even after contracts are signed

-

Fig.3: NSBPI and Producer Price Indexes for construction materials & steel

Fig.3: NSBPI and Producer Price Indexes for construction materials & steel

Sources: Bank of Japan, "Corporate Goods Price Index by Stage of Demand and Use - Intermediate Goods/Construction Materials," Economic Research Institute, “Construction Materials Price Index: Ordinary Steel (Tokyo)," prepared by Nikken Sekkei. -

Fig.4: Comments on materials prices, etc. in each company’s financial statements

Fig.4: Comments on materials prices, etc. in each company’s financial statements

Source: Prepared from each company's financial data

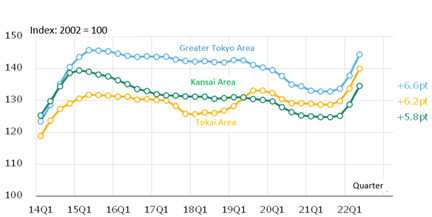

Upward Price Momentum Has Not Slowed, Rising About 10% On-Year

Nikken Sekkei Standard Building

Price Index (NSBPI)

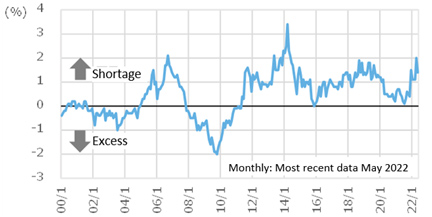

The prolonged delivery period for steel and materials has not improved, and if this affects construction schedules, it will lead to higher temporary construction costs and overhead expenses. It is thus necessary to keep a close eye on the situation.

-

Fig.5: NSBPI trends

Fig.5: NSBPI trends

-

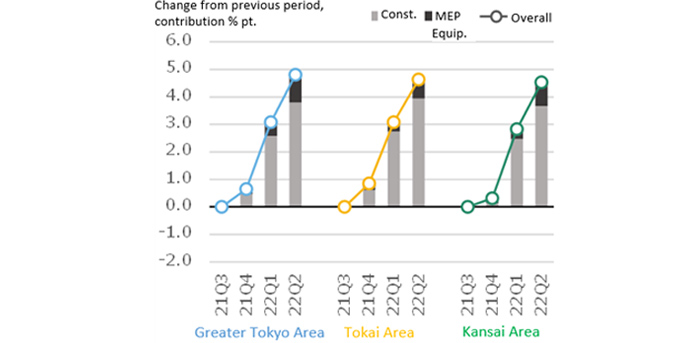

Fig.6: Percentage change in NSBPI & contribution of construction and equipment

Fig.6: Percentage change in NSBPI & contribution of construction and equipment

Steel Prices Rise Anew

The labor shortage feeling intensifies

-

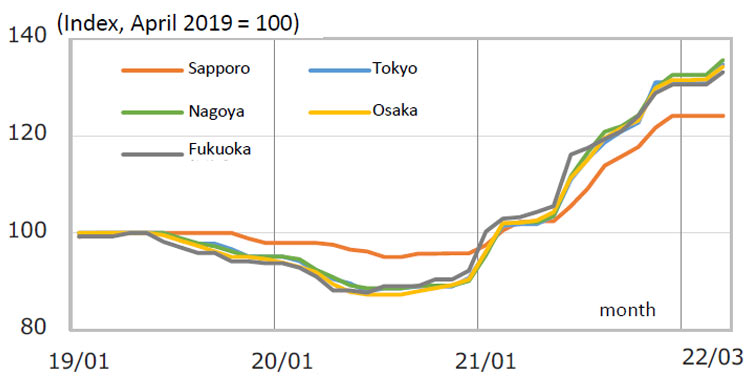

Fig.7: Change in steel prices (ordinary steel)

Fig.7: Change in steel prices (ordinary steel)

Source: Economic Research Institute “Construction Materials Price Index.” -

Fig.8: Changes in the ratio of excess/shortage of skilled construction workers

Fig.8: Changes in the ratio of excess/shortage of skilled construction workers

Source: Ministry of Land, Infrastructure, Transport and Tourism, "Survey of Construction Labor Supply and Demand” (total of 8 occupational categories, nationwide, seasonally adjusted).