Cost Management Report

「Construction Costs Continue to Rise; Steel Prices Cool, while MEP Work Orders Continue to Grow」

Scroll Down

This report has been prepared by the Cost Management Group of the Engineering Dept. of Nikken Sekkei Ltd for information purposes. The information in this report is current as of the date of publication. Its completeness is not guaranteed, however. The contents are subject to change without notice. Unauthorized reproduction of this report is prohibited.

Construction Costs Continue to Rise;

Steel Prices Cool, while MEP Work Orders

Continue to Grow

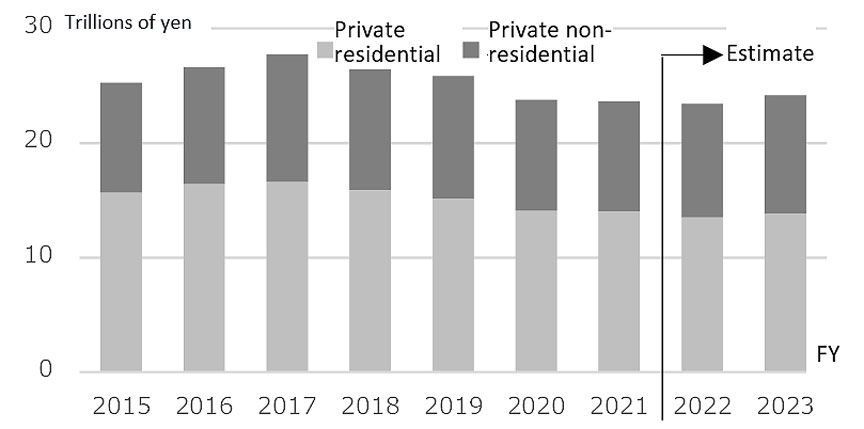

Upward trend in private-sector construction investment

A breakdown shows that although private-sector residential investment in FY2023 will decline 2% from FY2021, private-sector non-residential investment will increase 8%, boosting construction demand.

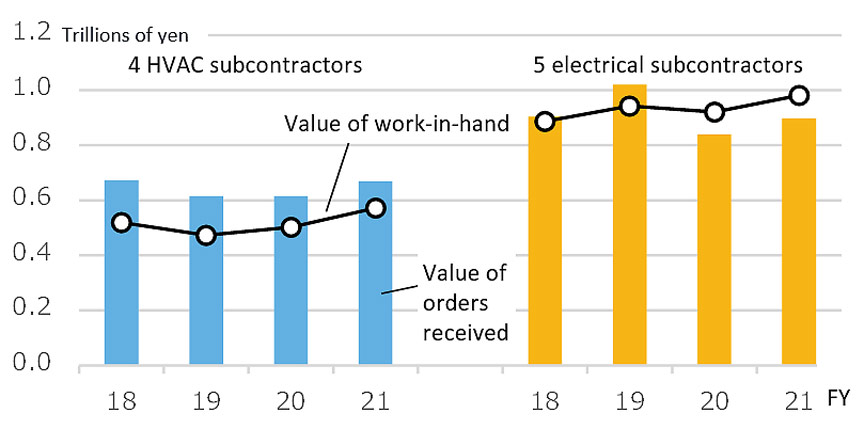

MEP subcontractors secure steady amount of work-in-hand

*1: The four major HVAC subcontractors: Takasago Thermal Engineering Co., Ltd., Taikisha Ltd., Sanki Engineering Co., Ltd., and DAI-DAN CO., LTD.

*2: The five major electrical subcontractors:

KINDEN CORPORATION, KANDENKO CO., LTD., KYUDENKO Corporation, Yurtec Corporation, and TOENEC CORPORATION.

-

Fig. 1: Trends in private-sector construction investment

Fig. 1: Trends in private-sector construction investment

(residential and non-residential)

Compiled from “Estimate of Construction Investment" by the Ministry of Land, Infrastructure, Transport and Tourism, and “Quarterly Outlook of Construction and Macro Economy" by the Research Institute of Construction and Economy (RICE) -

Fig. 2: Trends in orders received and construction work-in-hand by MEP subcontractors

Fig. 2: Trends in orders received and construction work-in-hand by MEP subcontractors

Prepared from each company's financial data

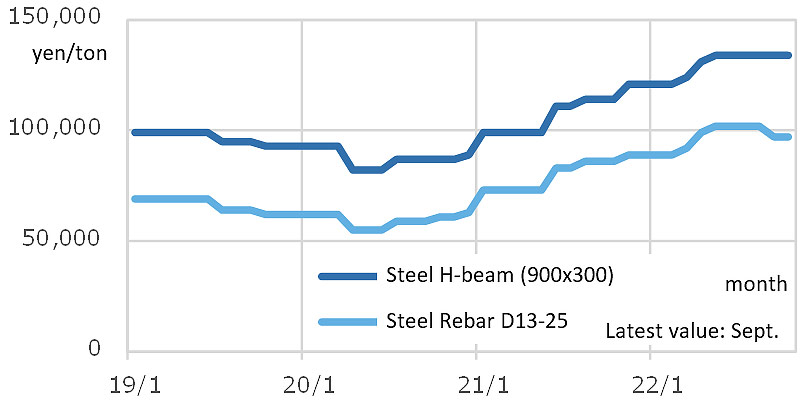

Steel Prices Cool

*3: AGC Inc., Nippon Sheet Glass Co., Ltd, Central Glass Co., Ltd.

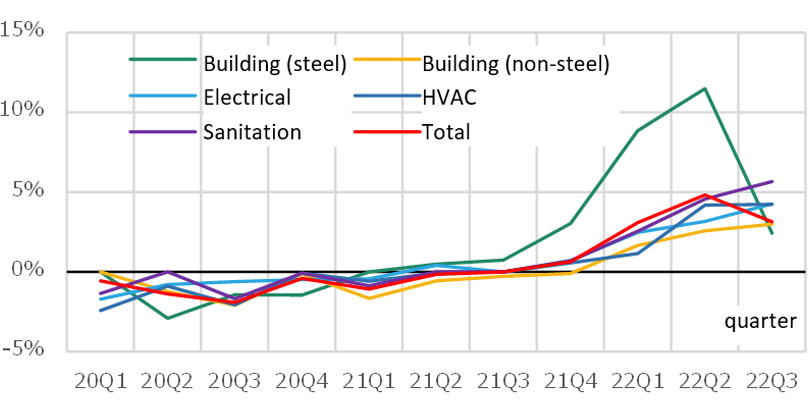

The rise in steel construction costs slow, while MEP construction expands

Except for some large-scale projects where competition for orders continues to be intense, increases in material prices and other costs tend to be passed along, and thus overall construction prices are unlikely to fall soon.

-

Fig. 3: Trends in steel sales prices

Fig. 3: Trends in steel sales prices

Prepared from Tokyo Steel Co., Ltd.’s "Construction Materials Price List" -

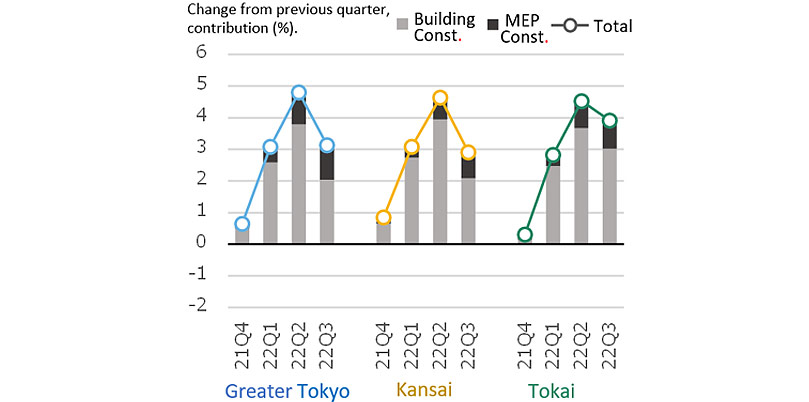

Fig. 4: Percent change in each NSBPI construction project on the previous quarter

Fig. 4: Percent change in each NSBPI construction project on the previous quarter

Prepared from Nikken Sekkei data

Building Construction Costs Slacken, while MEP Costs Accelerate; Composite Index Continues to Rise

Nikken Sekkei Standard Building Price Index (NSBPI)

Although upward pressure on steel materials prices softened, the main factor affecting the overall index, the upward trend in building material prices, remains strong, with manufacturers announcing price increases for glass and other materials from fall onward.

Increasingly, companies are having difficulty in selecting MEP subcontractors. Upward pressure on labor costs is intensifying, in addition to equipment.

-

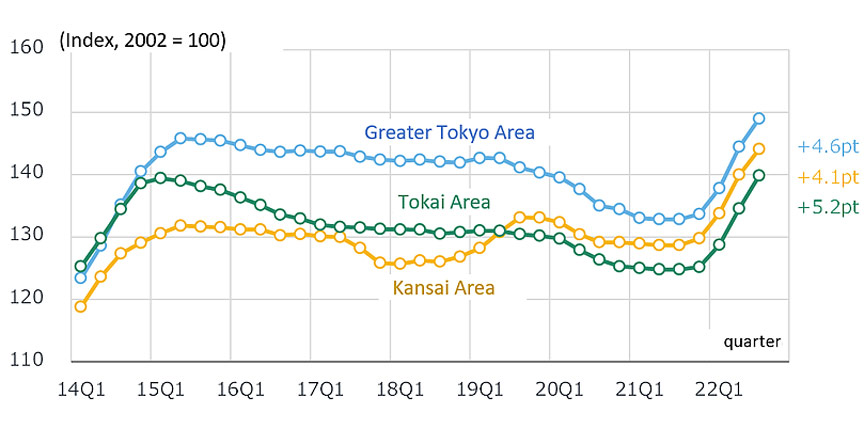

Fig. 5: Changes in NSBPI

Fig. 5: Changes in NSBPI

-

Fig. 6: Percent Change in NSBPI and Contribution of Building Work and MEP Work

Fig. 6: Percent Change in NSBPI and Contribution of Building Work and MEP Work

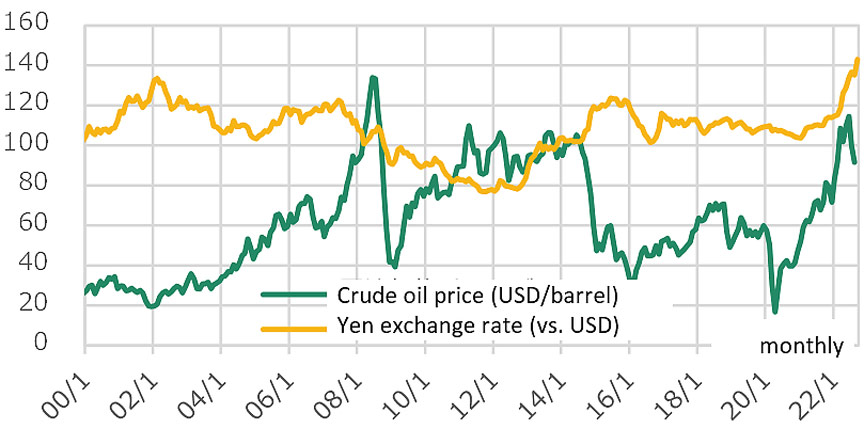

Crude prices decline, but the yen continues to depreciate

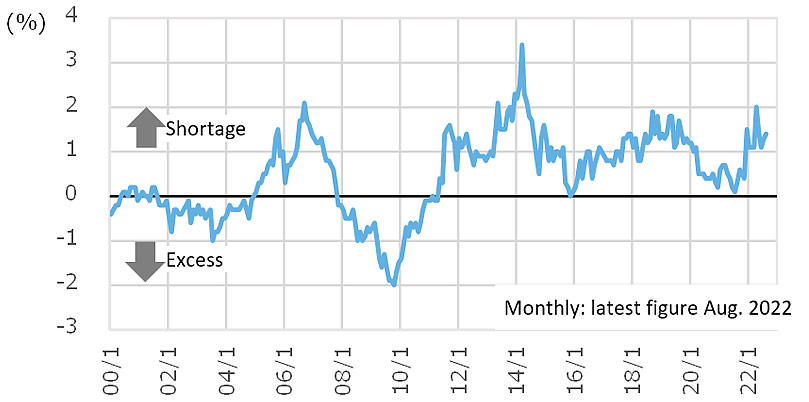

Sense of labor shortage remains at a high level

-

Fig. 7: Crude oil price and yen exchange rate

Fig. 7: Crude oil price and yen exchange rate

Compiled from "Commodity Prices" by The World Bank and "Exchange Rates" by the Bank of Japan -

Fig. 8: Construction Skilled Worker Excess/Shortage Ratio

Fig. 8: Construction Skilled Worker Excess/Shortage Ratio

Source: Ministry of Land, Infrastructure, Transport and Tourism, "Survey on Supply and Demand of Construction Labor" (eight job categories, nationwide, seasonally adjusted)