Cost Management Report

「Construction Prices Escalate Further On Strong Orders Due to Strong Orders and Continuing Materials Price Increases」

Scroll Down

This report has been prepared by the Cost Management Group of the Architectural Design Dept. of Nikken Sekkei Ltd for information purposes. The information in this report is current as of the date of publication. Its completeness is not guaranteed, however. The contents are subject to change without notice. Unauthorized reproduction of this report is prohibited.

Construction Prices Escalate Further On Strong Orders

Due to Strong Orders and Continuing Materials Price Increases

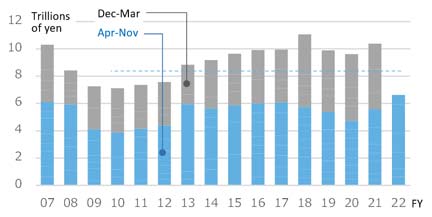

Orders received are steady

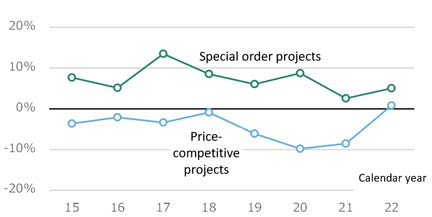

Price gap narrows between price-competitive projects and special orders

The average deviation rate (*1) for price-competitive projects remained at minus 9-10% in 2020 and 2021, but turned positive in 2022 (Fig. 2). As a result, price polarization with special order projects that had continued until last year is dissipating, indicating that price competition is becoming less likely going forward.

*1: Average deviation rate: Indicates how much the estimated price deviates from (or deviates below) the target price, averaged over all projects for each year.

-

Fig. 1: Trends in Construction Orders Received by the 50 Largest Firms

Fig. 1: Trends in Construction Orders Received by the 50 Largest Firms

Source: Ministry of Land, Infrastructure, Transport and Tourism's "Current Survey of Orders Received for Construction Work” (survey of 50 Major Construction Contractors). -

Fig. 2: Average Divergence Rate Between Price-competitive Projects and Special-Order Projects

Fig. 2: Average Divergence Rate Between Price-competitive Projects and Special-Order Projects

Source: Nikken Sekkei Ltd

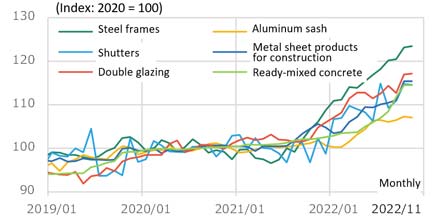

Materials prices continue to rise

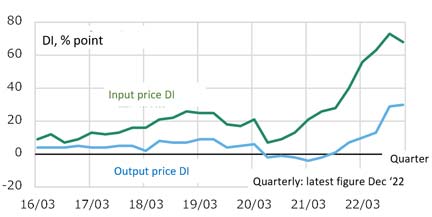

Output and input prices both rise, but divergence widens

Construction prices are likely to continue rising if conditions such as supply-demand gap tightening, and a spread of inflation sentiment continue to facilitate the transfer of cost price increases to construction costs.

-

Fig 3. Changes in Corporate Goods Price Index

Fig 3. Changes in Corporate Goods Price Index

Source: Bank of Japan's "Corporate Goods Price Index”. -

Fig. 4: DI for Output Price/Input Price Judgment (Construction, Large Enterprises)

Fig. 4: DI for Output Price/Input Price Judgment (Construction, Large Enterprises)

Source: Bank of Japan's "Short-term Economic Survey of Enterprises in Japan“ (“Tankan”).

Building & MEP Work Prices are Both Trending Upward

Nikken Sekkei Standard Building Price Index (NSBPI)

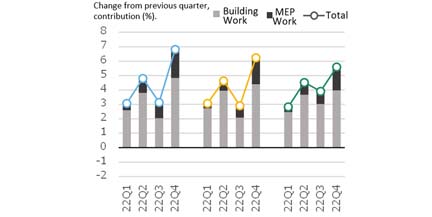

Cost pass-throughs are likely to continue for work types that are under strong upward pricing pressure, as construction contractors have a large number of projects on hand and orders are also strong.

-

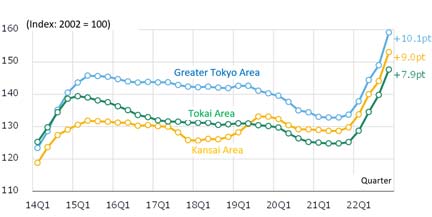

Fig. 5: Changes in NSBPI

Fig. 5: Changes in NSBPI

-

Fig. 6: Percent Change in NSBPI and Contribution of Building Work and MEP Work

Fig. 6: Percent Change in NSBPI and Contribution of Building Work and MEP Work

Ready-mixed concrete prices rise

Sense of labor shortage remains at a high level

-

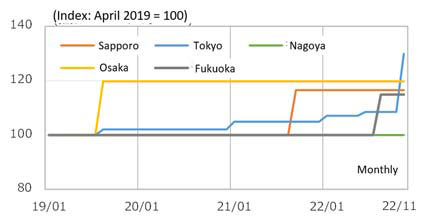

Fig. 7: Shift in Ready-mixed Concrete Prices

Fig. 7: Shift in Ready-mixed Concrete Prices

Source: Economic Research Association, “Cost Estimation Data”. -

Fig. 8: Changes in Construction Skilled Worker Excess/Shortage Ratio

Fig. 8: Changes in Construction Skilled Worker Excess/Shortage Ratio

Source: Ministry of Land, Infrastructure, Transport and Tourism, "Survey on Supply and Demand of Construction Labor" (eight job categories, nationwide, seasonally adjusted)