Cost Management Report

「Materials Prices Remain High, Labor Supply Constraints Severe,

Construction Prices Continue to Rise on the Back of Solid Demand」

Scroll Down

This report has been prepared by the Cost Management Group of the Architectural Design Dept. of Nikken Sekkei Ltd for information purposes. While the information in this report is current as of the date of publication, its completeness is not guaranteed. The contents are subject to change without notice. Unauthorized reproduction of this report is prohibited.

Materials Prices Remain High, Labor Supply Constraints Severe, Construction Prices Continue to Rise on the Back of Solid Demand

Factors contributing to higher construction prices: rising material prices, labor supply constraints, firm demand outlook

Material prices: a lull in upward momentum

-

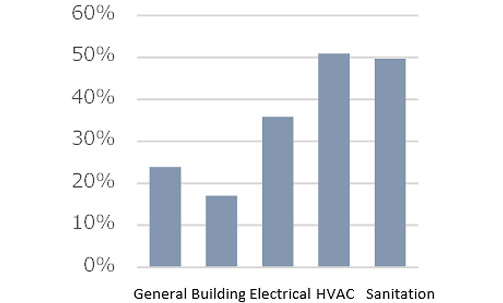

Fig.1: On-Year Comparison of NSBPI by Construction Work Type

Fig.1: On-Year Comparison of NSBPI by Construction Work Type

Compiled from Nikken Sekkei data. -

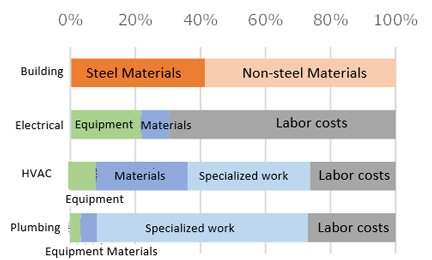

Fig.2: Breakdown of Reasons for Increase in Fig. 1

Fig.2: Breakdown of Reasons for Increase in Fig. 1

Compiled from Nikken Sekkei data.

Materials include ductwork costs. -

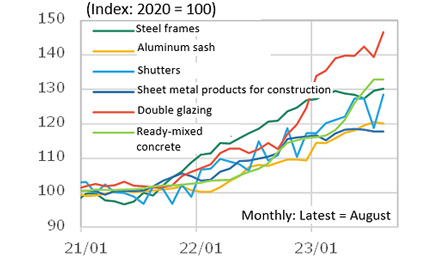

Fig. 3: Price Index Trends for Building Materials

Fig. 3: Price Index Trends for Building Materials

Compiled from the Bank of Japan’s Corporate Goods Price Index.

Labor supply constraints continue due to labor shortages, the 2024 Problem, etc.

Forecast: Steady construction demand to put upward pressure on prices

-

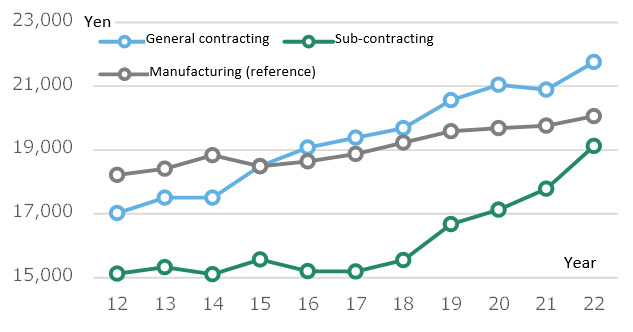

Fig. 4: Construction Industry Daily Wage Trends

Fig. 4: Construction Industry Daily Wage Trends

Compiled from the Ministry of Health, Labor and Welfare's "Monthly Wage Survey (of businesses of five or more employees), calculated as follows: Prescribed salary ÷ prescribed working hours × 8 hours + special paid salary ÷ number of days worked. -

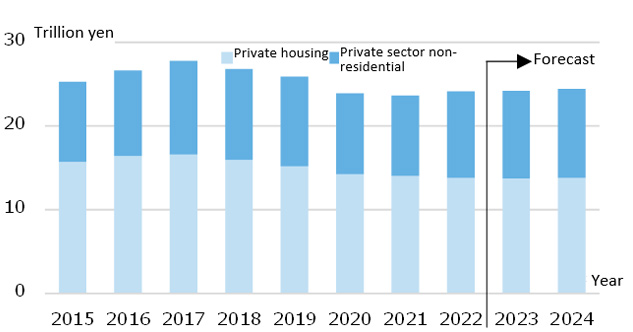

Fig. 5: Real Construction Investment (Private Construction) Trends

Fig. 5: Real Construction Investment (Private Construction) Trends

Compiled from the Ministry of Land, Infrastructure, Transport and Tourism's "Construction Investment Forecasts" and the Research Institute of Construction and Economy’s "Construction Investment Forecasts Based on the Construction Economics Model”.

Composite Index Continues to Rise

Nikken Sekkei Standard Building Price Index NSBPI*1

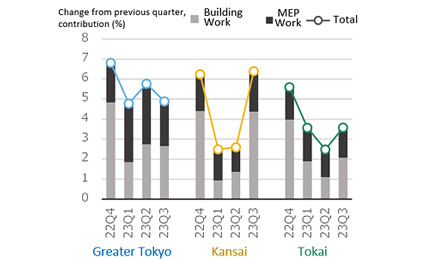

In building work, temporary work, steel frame, ready-mixed concrete, and finishing work categories are rising. MEP work was affected by rising labor costs and specialized work prices due to labor supply constraints. Overhead rates also rose and upward momentum remains strong (Fig. 7).

-

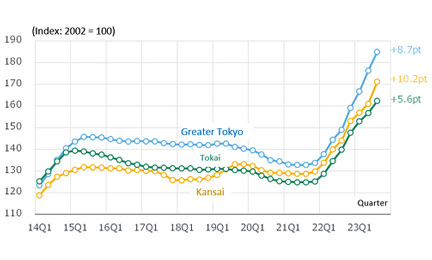

Fig. 6: Changes in NSBPI

Fig. 6: Changes in NSBPI

-

Fig. 7: Percent Change in NSBPI and Contribution of Building Work and MEP Work

Fig. 7: Percent Change in NSBPI and Contribution of Building Work and MEP Work

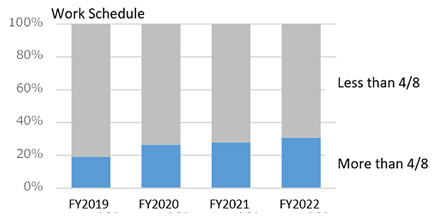

Steps to achieve a “four-week/ eight-days closed” work schedule accelerate due to the 2024 Problem

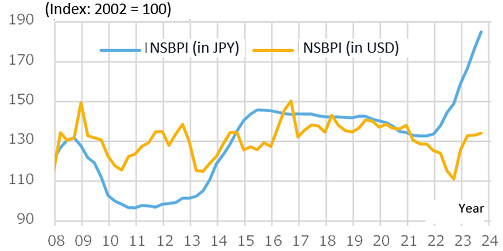

NSBPI remains flat in US dollar terms due to yen depreciation

In U.S. dollar terms, construction prices have fluctuated less than they did in Japanese yen terms after the 2008 GFC, remaining mostly unchanged (Fig. 9). Foreign investors see the recent sharp rise in yen-denominated assets as offset by a weaker yen. While the yen's depreciation is one factor in yen-denominated price appreciation, the main factor is as noted above.

-

Fig. 8: Trends in Implementation of the Four-week/Eight-days closed Work Schedule

Fig. 8: Trends in Implementation of the Four-week/Eight-days closed Work Schedule

Prepared by the Japan Federation of Construction Contractors from the "Action Plan to Achieve a Two-days off Workweek: FY2022 Full-year Follow-up Report.” -

Fig.9: Changes in the NSBPI (in U.S. dollars)

Fig.9: Changes in the NSBPI (in U.S. dollars)

Compiled from Nikken Sekkei data and the Bank of Japan's "Exchange Rates".

U.S. dollar indexes are estimated based on September 2008 exchange rates.

*1: Nikken Sekkei Standard Building Price Index (NSBPI):

An index showing price movements in construction prices, calculated independently by Nikken Sekkei Ltd. The index is calculated using standard tenant office space as a quantitative model and reflects actual construction prices determined by Nikken Sekkei‘s own surveys as needed. The first quarter (Q1) is from January to March, Q2 is from April to June, Q3 is from July to September, and Q4 is from October to December.

*2: The issue of overtime caps, due to be applied to the construction and logistics industries from April 2024.